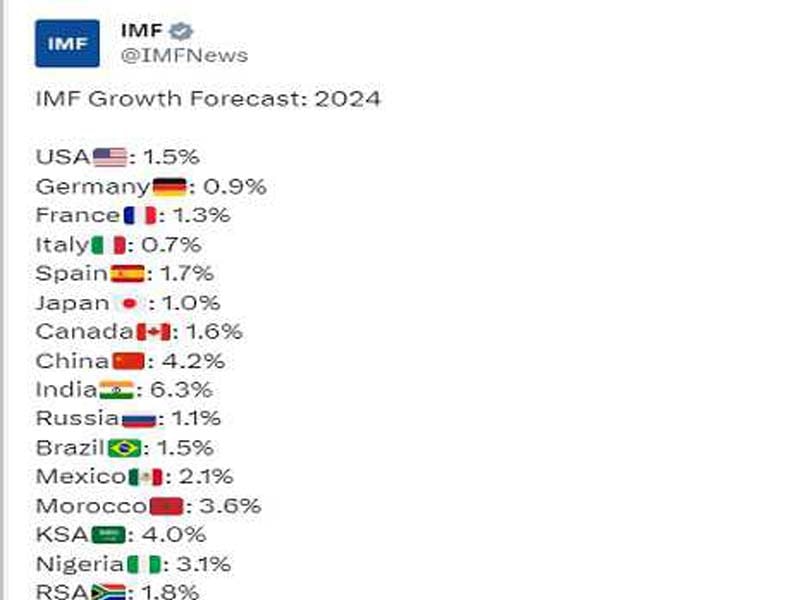

The IMF updates its FY24 GDP growth forecast for India to 6.3 percent.

NEW DELHI, OCT 10 : The International Monetary Fund (IMF) on Tuesday raised India’s gross domestic product (GDP) growth forecast for financial year 2023-24 to 6.3% from 6.1% projected earlier.

“Growth in India is projected to remain strong, at 6.3 percent in both 2023 (FY24) and 2024 (FY25), with an upward revision of 0.2 percentage point for 2023, reflecting stronger-than-expected consumption during April-June,” IMF said in its latest World Economic Outlook.

The IMF’s growth forecast is only a tad lower from the Reserve Bank of India (RBI)’s 6.5%. The World Bank had earlier this month projected India’s GDP growth for the current financial year at 6.3%.

The IMF in its latest report said that global recovery from the COVID-19 pandemic and Russia’s invasion of Ukraine remains slow and uneven.

“Despite economic resilience earlier this year, with a reopening rebound and progress in reducing inflation from last year’s peaks, it is too soon to take comfort. Economic activity still falls short of its pre-pandemic path, especially in emerging markets and developing economies, and there are widening divergences among regions,” the IMF report said.

It further said that several forces are holding back the recovery with some of them reflecting the long-term consequences of the pandemic, the war in Ukraine, and increasing geo-economic fragmentation.

“Others are more cyclical in nature, including the effects of monetary policy tightening necessary to reduce inflation, withdrawal of fiscal support amid high debt, and extreme weather events,” it said.

The IMF has projected global growth to slow from 3.5% in 2022 to 3% in 2023 and 2.9% in 2024.

The IMF report noted that the strongest recovery among major economies has been in the United States, where GDP in 2023 is estimated to exceed its pre-pandemic path.

“The euro area has recovered, though less strongly—with output still 2.2 percent below pre-pandemic projections, reflecting greater exposure to the war in Ukraine and the associated adverse terms-of-trade shock, as well as a spike in imported energy prices,” it said.

The report further said, “In China, the pandemic-related slowdown in 2022 and the property sector crisis contribute to the larger output losses of about 4.2 percent, compared with pre-pandemic predictions. Other emerging market and developing economies have seen even weaker recoveries, especially low-income countries, where output losses average more than 6.5 percent.”(UNI)